A dose of 'healthy paranoia' will thrive in the post-covid credit space

After working through an incredibly eventful year in the global economy, investors in private credit benefitted from the stable and consistent yields of the asset class*. That was welcomed by investors, who went through a rollercoaster in the public markets. For eQ’s private credit funds **, 2020 ended in a good state with no permanent write-offs having been recorded, keeping default rates to zero in both funds.

However, the pandemic is not over yet and defaults represent a rising risk for 2021. In looking more closely at the portfolios, however, the borrower companies are generally in good shape and on fundamentally stable ground. The private equity sponsors and borrower company management worked hard in the early days of the pandemic to conserve cash, develop new solutions for the business and cut opex, which generally helped to ward off a liquidity crunch. Whereas some changes are more long-lasting and business models may need readjusting, the truest value comes from co-operating with the most experienced private equity sponsors who have the ability to demonstrate value during a crisis. Throughout the year, MV Credit safeguarded our portfolios by bolstering an already strong monitoring process with continued assessment and regular communication with the private equity owners.

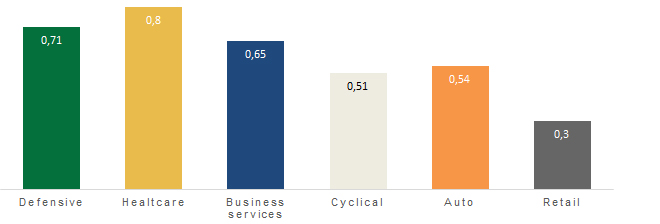

Consistently with previous years, eQ continues to invest primarily in secured senior loans. As has been expected, the preference for investing in Healthcare and Information Technology has once again proved crucial in weathering the storm. In eQ private credit funds, these industries represent more than 60% of total assets. It has become even more evident that the increased risk related to cyclical companies is not worth taking when hunting for higher yield. A private credit manager is ultimately judged on their loss rate so minimising this is key. That is supported also by LCD data from the past 16 years, Sharpe ratios of senior loans issued for defensive sectors clearly outperform those in the cyclical ones. In fact, the Healthcare sector comes out as a clear winner in terms of the risk-reward relationship, and not only from this specific pandemic period accelerating the demand for healthcare services, but over the entire 16 year period. Whereas defensive sectors have always been favoured by MV Credit, Healthcare and Information Technology made up 85% of new investments in 2020. This is a trend which we expect to continue.

* excluding a potential FX impact

** eQ Private Credit and Private Equity funds are intended only for professional investors.

Sharpe ratios – Risk-adjusted return by sector (Credit Market)

Past performance or risk is not an indication of future outcomes.

Source: LCD for private credit markets (31.1.2004-31.12.2020)

When the world around us has fundamentally changed, we anticipate no change in our investment strategy going forward. By continuing to focus on downside risk and incorporating an attitude of ‘healthy paranoia’ in the investment approach, we believe we will continue to deliver attractive returns to our investors. Overall, market participants expect 2021 to start off strong as private equity managers seek to invest their vast amount of dry powder at attractive valuations. However, with the recent increase in COVID-19 infection rates across Europe and the associated measures, we would expect investors to remain cautious on financing businesses that could potentially be adversely affected again. Whereas the strongest credits continue to come to the market first, we believe the second half of the year will be especially strong, which in turn shall put eQ’s newest private credit fund in a very good position in terms of volume and quality at the year end.

Finally, ESG remains a high priority. Lenders are seeking more transparency from the private equity sponsors and management teams, and recently there have been some transactions structured in 2020, which include ESG KPI-linked clauses, which could benefit borrowers if they score well. eQ Credit participated in its first ESG-linked loan at the end of 2020. ESG remains to be on hearts of MV and eQ also going forward believing that it will have a positive impact on returns.

Whilst the economic outlook still remains uncertain, before the vaccine roll-out takes place, we believe the experience of the MV Credit team investing through multiple cycles (20+ years) will help to navigate even if the choppy waters would continue.

Written by

|

|

| Elina Tourunen

Investment Director |

Harry Elliott

Associate |